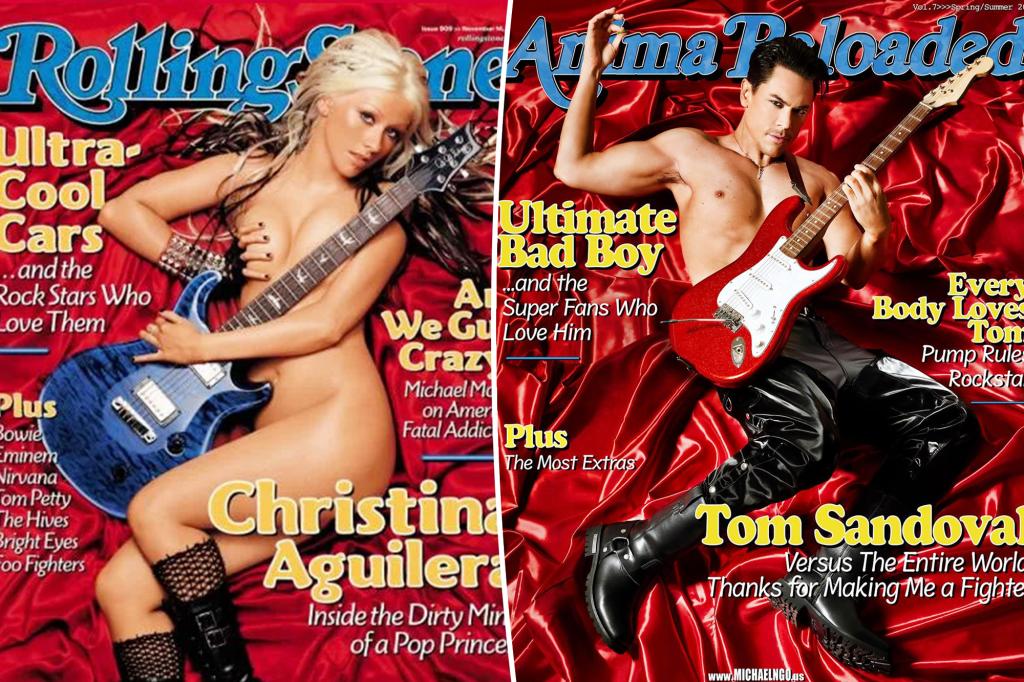

Tom Sandoval, a star of “Vanderpump Rules,” recently recreated Christina Aguilera’s iconic 2002 Rolling Stone cover for designer Michael Ngo’s new “Anima Reloaded” fashion campaign. The photos were shared on Instagram on Tuesday, showing Sandoval posing shirtless for a faux magazine cover while wearing black latex pants and biker boots, holding a guitar. He channeled the “Fighter” singer and rocked heavy black eyeliner for the shoot, with his hair slicked back and a lightning bolt necklace completing the look.

Ngo’s post on Instagram invited fans to vote for the “MOST ICONIC XTINA ERA,” thanking Tom for being a great friend and supporter of the campaign. The designer praised Sandoval for being a rockstar in the creative campaign. In a later post on Wednesday, Ngo shared an Instagram Reel showing Sandoval in full rock star mode, screaming into a microphone while wearing a studded black leather jacket and matching pants with flames on them. The clip also showed off the shirtless look featured on the magazine cover.

While some fashion fans were not convinced by Ngo’s choice of Sandoval as the star of his campaign, with a few comparing it to Zoolander and calling it cringeworthy, others showed support for the reality star. Some fans left comments praising Sandoval, calling him hot and cooler than what his girlfriend, Ariana Madix, is doing. Others simply commented on how much they loved the campaign and Sandoval’s portrayal of the iconic Christina Aguilera look.

Ariana Madix, Sandoval’s girlfriend, has been making some moves of her own, buying a $1.6 million home in Los Angeles and finally moving out of the house she shared with Sandoval. Despite the controversy surrounding Sandoval and his past actions, the fashion campaign featuring him in the iconic Christina Aguilera look seems to have garnered mixed reactions from fans and critics alike. Sandoval’s involvement in the campaign has sparked conversation on social media, with supporters cheering him on and others questioning Ngo’s choice in featuring him.