At 78 years old, Steve Martin has finally reached his ’70s, though many have joked that he has looked like a senior citizen for decades due to his prematurely gray hair. Rather than hiding his gray hair with dye, Martin embraced it and found that it actually helped his career. In his new two-part documentary series on Apple TV+, Steve!, Martin explains how his gray hair added a level of maturity to his act that was beneficial for his comedy career. This new series began streaming on Friday, offering fans a deeper look into Martin’s life and career.

Before he rose to fame in the ’70s, Martin had been sporting a stereotypical “hippie” look in the ’60s. However, he soon realized that this look was hindering his success in the comedy world and decided to make a change. Martin made the decision to adopt a more clean-cut appearance by wearing suits, ties, and cutting his hair, opting for a more polished and professional look that set him apart from the previous generation of comedians. This change, paired with his gray hair, helped to establish Martin as a unique and memorable performer.

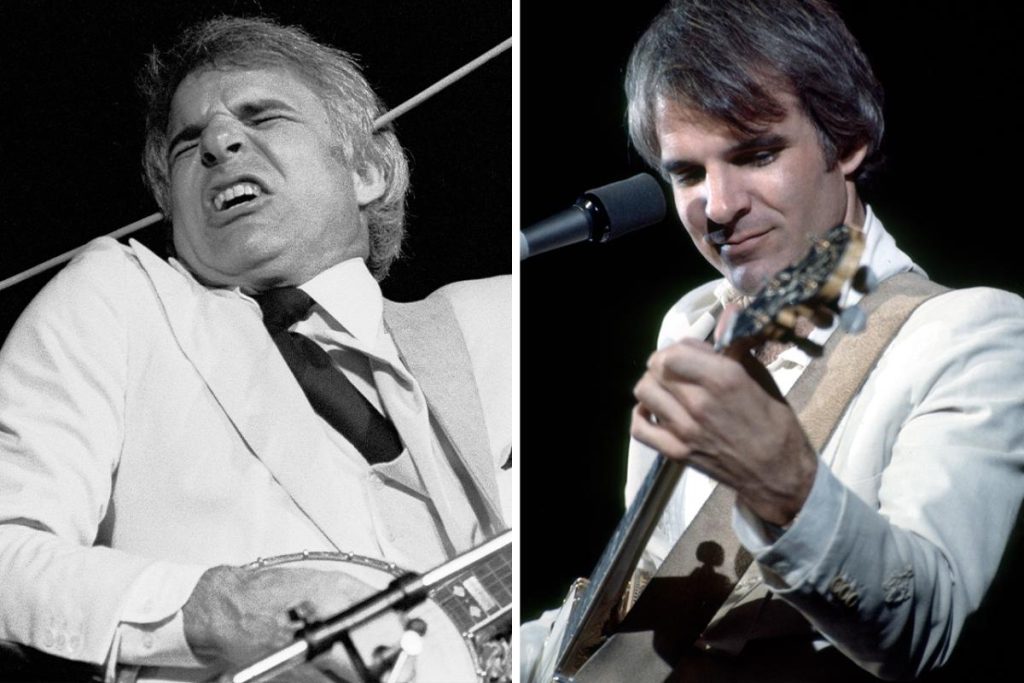

Martin’s unconventional stand-up routine, which included wild movements, banjo playing, and the use of props, was in stark contrast to his mature appearance and gray hair. This juxtaposition added to the charm and appeal of his act, making him stand out in the world of comedy. Despite initial doubts about whether his new look would be successful, Martin’s clean-cut appearance combined with his comedic talent helped him become one of the most famous and successful comedians of all time.

The lesson to be learned from Martin’s experience is that gray hair should not be seen as a negative factor in one’s life or career. In fact, for Martin, embracing his gray hair and aging gracefully actually enhanced his professional image and contributed to his success as a performer. By staying true to himself and not conforming to societal norms regarding aging, Martin was able to carve out a unique path in the comedy world and establish himself as a comedic icon. This lesson serves as a reminder that embracing one’s natural appearance and aging with grace can lead to unexpected opportunities and successes.

Steve Martin’s new documentary series, Steve!, is now available for streaming on Apple TV+, offering fans an intimate look into his life and career. Through this series, viewers can gain a deeper understanding of Martin’s journey in the world of comedy, his approach to aging, and how his unique style and appearance have contributed to his success. By sharing his story and insights, Martin continues to inspire audiences to embrace their individuality and pursue their passions, regardless of societal expectations or perceptions. As he enters his seventh decade, Steve Martin remains a beloved and respected figure in the world of entertainment, proving that age is just a number and that true talent and authenticity are timeless.