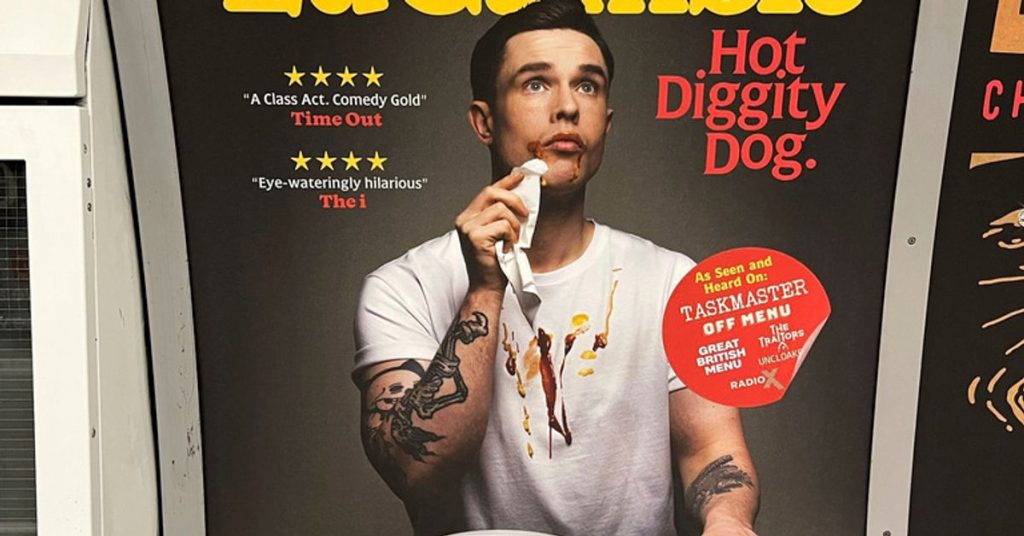

UK comedian faces hot dog removal due to junk food ban

A well-known UK comedian is facing the removal of his famous hot dog stand due to a newly implemented junk food ban in the area. The comedian, who has been operating the stand for years, is now at risk of losing his business and livelihood as a result of the ban. The decision to ban junk food in the area has sparked controversy and debate among residents and officials, with many questioning the impact it will have on local businesses and the community as a whole.

The comedian, who is known for his unique brand of humor and popular hot dogs, has been a fixture in the community for years. His stand has become a beloved spot for locals and tourists alike, who flock to enjoy his tasty hot dogs and friendly banter. However, with the new ban in place, the future of the stand is uncertain, leaving the comedian and his customers worried about what will happen next.

Supporters of the junk food ban argue that it is necessary to address the growing issue of obesity and unhealthy eating habits in the community. They believe that by restricting the availability of junk food, they can encourage residents to make healthier choices and improve their overall well-being. However, critics of the ban argue that it unfairly targets small businesses like the comedian’s hot dog stand and may do more harm than good in the long run.

The comedian has launched a campaign to save his hot dog stand, rallying support from fans and local residents who are eager to see it stay in business. He has garnered thousands of signatures on a petition urging officials to reconsider the ban and allow him to continue operating his beloved stand. In addition to the petition, the comedian has also taken to social media to raise awareness about the issue and garner support for his cause.

Despite the controversy surrounding the junk food ban, the comedian remains optimistic about the future of his hot dog stand. He is determined to fight for his business and the community that has supported him for so long, and is hopeful that a compromise can be reached that allows him to continue serving his popular hot dogs to loyal customers. As the debate rages on, the fate of the comedian’s hot dog stand hangs in the balance, leaving many wondering what will happen next in this ongoing saga.